Oil prices rose on Friday, continuing an upward trend after OPEC+ this week agreed to tighten global supply with a deal to cut production targets by 2 million barrels per day (bpd).

The cut from the Organization of Petroleum Exporting Countries and allies including Russia, together known as OPEC+, is its largest reduction since 2020 and comes ahead of a European Union embargo on Russian oil. The decision would squeeze supplies in an already tight market, adding to inflation.

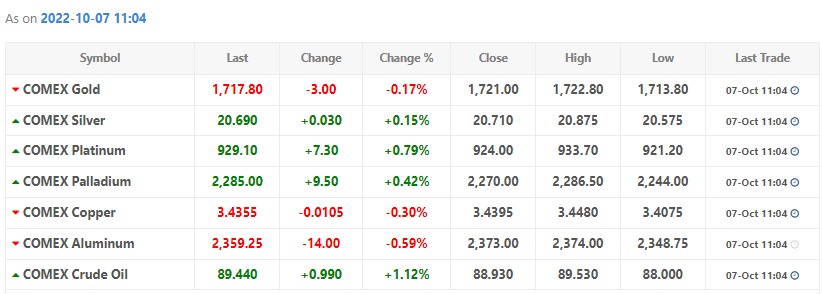

Brent crude

futures rose 19 cents to $94.61 a barrel by 0002 GMT. WTI crude

futures rose 24 cents to $88.69 a barrel, after earlier hitting $89.37 per barrel, the highest since Sept. 14.

U.S. President Joe Biden expressed disappointment on Thursday over OPEC+’s plans and he and officials said the United States was looking at all possible alternatives to keep prices from rising. Some of those options include releasing more oil from the Strategic Petroleum Reserve or exploring a curb on energy exports by U.S. companies.

Goldman Sachs has raised its oil price forecast for this year and 2023, as the U.S. bank expects OPEC+’s output cut to be “very bullish” for prices going forward. It raised its 2022 Brent price forecast to $104 per barrel from $99 per barrel and 2023 forecast to $110 per barrel from $108 per barrel.

Recent Comments