Gold extended its recovery on Monday buoyed by a pullback in U.S. Treasury yields and some safe-haven buying spurred by COVID-19 related concerns, with investors looking for more direction from the Federal Reserve on monetary policy.

Fundamentals

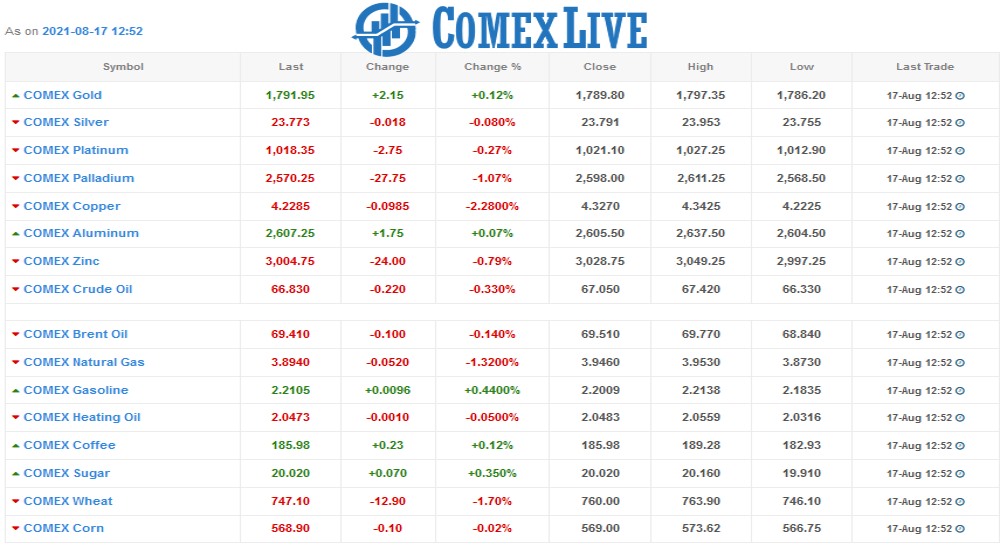

Spot gold rose 0.5% to $1,787.76 per ounce by 1440 GMT, erasing declines from earlier in the session. U.S. gold futures gained 0.6% to $1,788.10.

Prices jumped more than 1% on Friday after data showed U.S. consumer sentiment plummeted in August, helping the metal recover from steep declines in the earlier part of last week after bets for tapering got a fillip from recent strong labour data.

While COVID-19-related safe-haven buying has been seen in Europe, the U.S. market has not seen the same level of interest, said TD Securities commodity strategist Daniel Ghali, adding a rising trend of higher gold purchases from central banks are providing underlying support to bullion.

“We’re seeing an aftermath of a significant positioning squeeze in gold” with the large amount of short positions accumulated as Fed taper talks grew louder now being covered, Ghali added.

Investors now await direction from Fed Chairman Jerome Powell and the central bank’s minutes from its July policy meeting.

U.S. Treasury yields were pinned near more than a week low, reducing the opportunity cost of holding the non-interest bearing bullion.

Markets are also keeping a close watch on turmoil in Afghanistan.

“Over the weekend, the political situation in Afghanistan deteriorated drastically … this might potentially affect the financial markets and the gold price, which we will find out over the next few days,” said Carlo Alberto De Casa, market analyst at Kinesis.

Gold is often used as a safe store of value during political and financial uncertainty.

Silver was little changed at $23.75 per ounce, platinum fell 0.6% to $1,020.52, and palladium fell 2.6% to $2,580.87.

Recent Comments