Gold rose more than 1% on Friday as a retreat in the dollar enticed investors to snap up the bullion following its recent sell-off.

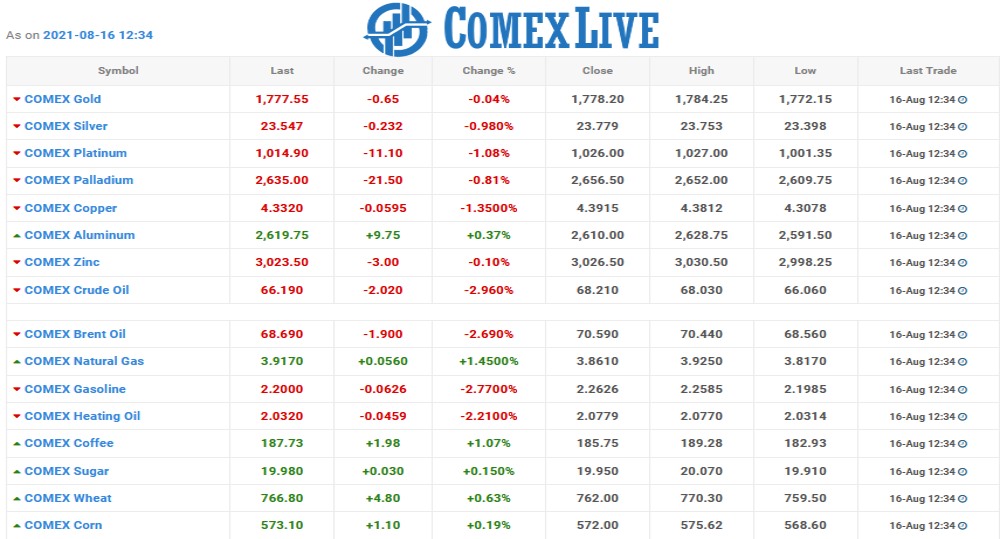

Spot gold rose to $1,772.80 per ounce by 10:26 a.m. ET, after hitting its highest in more than a week at $1,774.30, in a sharp recovery from over four-month lows touched on Monday.

U.S. gold futures rose 1.4% to $1,775.80.

The dollar index fell 0.4% and U.S. benchmark 10-year treasury yields also weakened, bolstering gold’s appeal.

Providing further support to bullion was increased physical demand, particularly from top consumers India and China, where premiums rebounded to multi-month highs.

TD Securities commodity strategist Daniel Ghali said gold’s pull back from Monday’s lows was largely driven by technicals, with increased central bank purchases providing additional support.

“But, this pullback could just be a temporary move higher,” Ghali said, noting that speculative interest was waning, amid rising expectations that the U.S. Federal Reserve could cut back on economic support sooner.

The taper bets got a fillip from a strong U.S. jobs report last week.

“The picture remains nuanced; as positive signs in the labor market and spikes in producer prices support the view that the Fed will bring forward the timing of tapering, but the latest consumer price increases supported the view that inflation spikes are transitory,” said Ricardo Evangelista, a senior analyst at ActivTrades.

“Amidst the mixed signals, investors anticipate what will emerge from the Fed’s Jackson Hole meeting later this month.”

While gold is seen as a hedge against inflation, higher interest rates dull the bullion’s appeal by raising its opportunity cost.

Silver gained 2.5% to $23.74 per ounce, but was down about 2.6% for the week.

Platinum rose 0.7% to $1,025.37 and palladium was up 1.1% at $2,653.33.