Oil prices edged lower on Tuesday, taking a breather from a sustained rally driven by strong demand in the United States, the world’s biggest consumer of oil and its products.

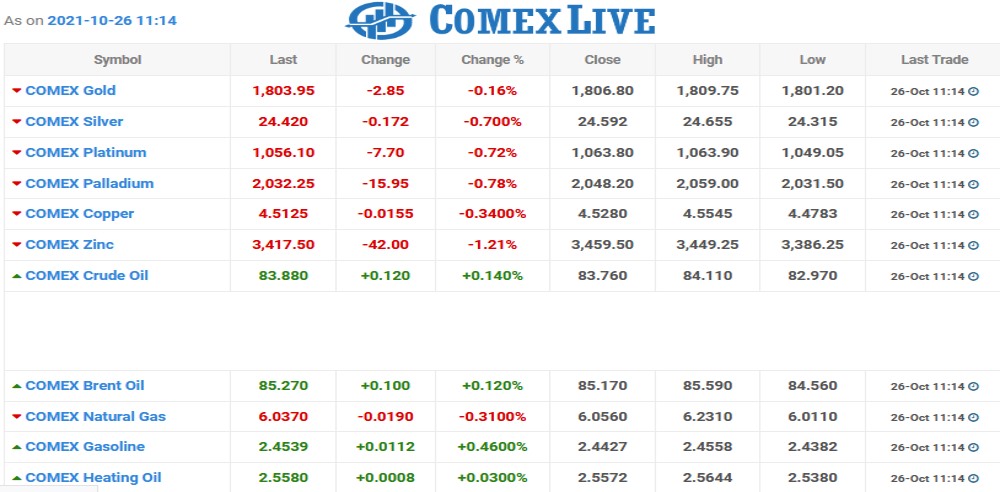

Brent crude was down 20 cents or 0.2% at $85.79 a barrel by 0143 GMT, after gaining 0.5% on Monday. U.S. oil was down 21 cents or 0.3% at $83.55 a barrel, having finished unchanged the previous session after testing new highs.

While China’s red-hot power and coal markets have cooled somewhat after government intervention, energy prices remain elevated worldwide as temperatures fall with the onset of the northern winter.

“Forecasts for a colder November have energy traders bracing for a very tight market that will be met (with) unprecedented demand this winter,” OANDA senior market analysts Edward Moya said in a note.

“This oil market will remain tight and that should mean a headline or two away from $90 oil,” he added.

Goldman Sachs said Brent is likely to push above its year-end forecast of $90 a barrel. The bank estimated switching to oil from gas may add 1 million barrels per day (bpd) to oil demand.

Gasoline and distillate consumption is back in line with five-year averages in the United States after more than a year of depressed demand.

The market will be closely watching U.S. inventory levels this week. Crude oil stockpiles are forecast to have risen by 1.7 million barrels last week, according to a Reuters poll of analysts. Gasoline and distillate inventories were expected to fall, however.

Recent Comments