Oil prices were little changed in early Asian trade on Monday, after settling down $2 a barrel on Friday, as rising supplies in the United States and forecasts of more interest rate hikes cooled optimism over China’s demand recovery.

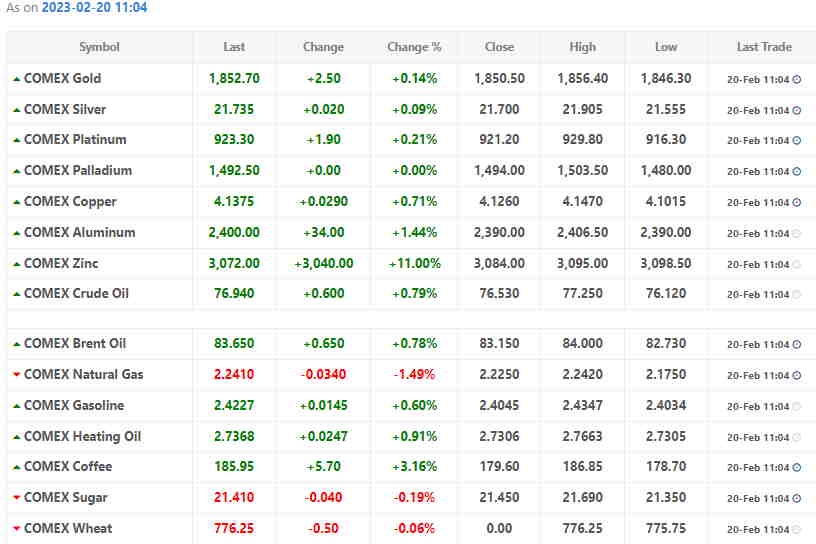

Brent crude

slid 9 cents, or 0.1%, to $82.91 a barrel by 0051 GMT. U.S. West Texas Intermediate crude

for March, which expires on Tuesday, was at $76.40 a barrel, up 6 cents. The more active April contract fell 9 cents to $76.46.

The benchmarks closed lower by about 4% last week after the United States reported higher crude and gasoline inventories.

Washington also announced plans to release 26 million barrels of crude from the Strategic Petroleum Reserve which could lead to higher stockpiles at Cushing, Oklahoma, the delivery point for WTI contracts, until May, Energy Aspects analysts said in a note.

Expectations that the U.S. Federal Reserve will continue raising interest rates which could strengthen the dollar also capped oil prices. A stronger greenback makes dollar-denominated oil more expensive for holders of other currencies.

In another sign of improving supplies, Kazakhstan will supply 100,000 tons of oil via Russia’s Druzhba pipeline to Germany in March for the PCK Schwedt refinery.

In Asia, investors are eying the People’s Bank of China’s decision on its mortgage rates to support recovery in the property sector and its economy, CMC Markets analyst Tina Teng said. China is the world’s largest crude oil importer.

Analysts expect China’s imports to hit an all-time high in 2023 due to increased demand for transportation fuel and as new refineries come onstream.

China, along with India, have become top buyers of Russian crude following the European Union embargo.

India’s Russian oil imports hit a record 1.4 million barrels per day in January, trade data showed.