Oil prices rose in early Asian trade on Thursday, bouncing off multi-month lows in the previous session caused by data signaling weak U.S. fuel demand.

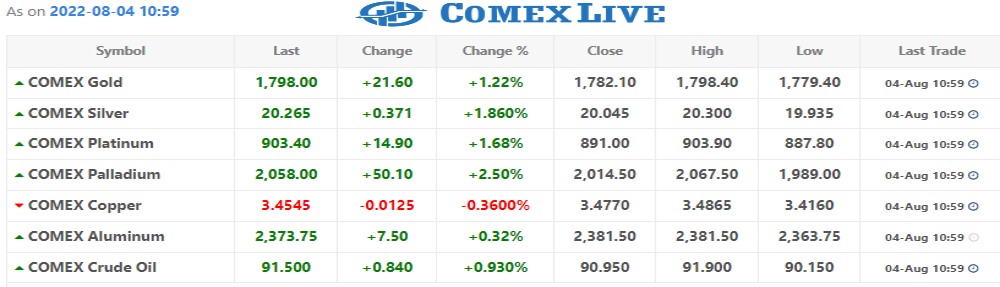

Brent crude futures rose 53 cents, or 0.6%, at $97.31 a barrel by 0020 GMT while West Texas Intermediate (WTI) crude futures rose 55 cents, also a 0.6% gain, to $91.21. Both benchmark fell to their weakest levels since February in the previous session.

U.S. crude oil inventories rose unexpectedly last week as exports fell and refiners lowered runs, while gasoline stocks also posted a surprise build as demand slowed, the Energy Information Administration said.

On the supply side, ministers for the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, known as OPEC+, agreed to a small increase in the group’s output target, equal to about 0.1% of global oil demand.

While the United States has asked the group to boost output, spare capacity is limited and Saudi Arabia may be reluctant to beef up production at the expense of Russia, hit by sanctions over the Ukraine invasion that Moscow calls “a special operation.”

Ahead of the meeting, OPEC+ trimmed its forecast for the oil market surplus this year by 200,000 barrels per day to 800,000 bpd, three delegates told Reuters.

Supporting prices, the Caspian Pipeline Consortium (CPC), which connects Kazakh oil fields with the Russian Black Sea port of Novorossiisk, said that supplies were significantly down, without providing figures.