Once overlooked, now unignorable: The potential for tactical gains in Silver amidst the prominence of Gold. Silver continues to be undervalued in the context of gold’s recent ascent, as evidenced by the gold-silver ratio reaching a historic high approaching 100:1. Structural deficits, increasing industrial demand, and a track record of historical outperformance position silver as an intriguing tactical investment opportunity. Analysts advocate for a methodical 5% allocation to portfolios through ETFs, with expectations of a 50–115% upside as silver seeks to recover lost ground.

In the prominent realm of precious metals, gold has been capturing significant attention. However, astute investors recognize that often the most promising opportunities are found in less visible areas. While gold has surged to remarkable levels, hitting $3,500 in April 2025, silver has remained relatively stagnant, finding it challenging to surpass the $35 threshold. This notable divergence merits further scrutiny. The disparity becomes even more compelling when we examine August 2011, a period when gold was valued at approximately $1,900 and silver was priced at $45 per troy ounce.

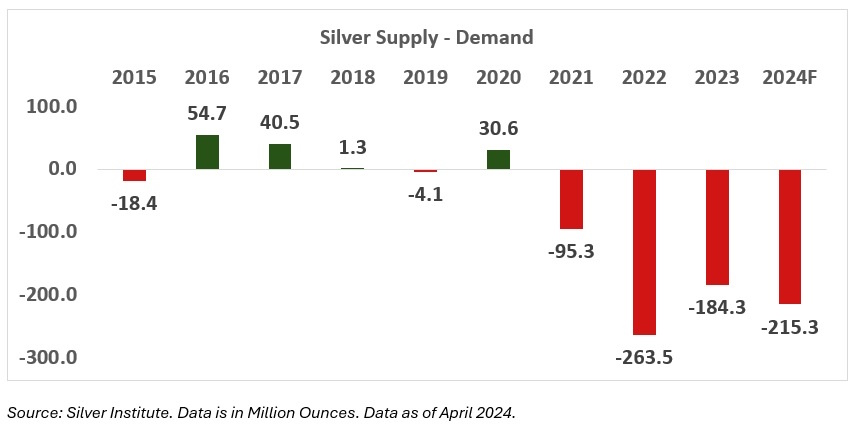

Fast forward to today, and gold has nearly doubled, whereas silver has experienced a decline. This unusual dynamic has elevated the gold-to-silver ratio to around 100:1, nearing historical extremes and considerably surpassing its 25-year average of 68:1. The current silver market is particularly compelling due to the ongoing supply-demand imbalance. If projections hold true, 2025 will signify the fifth consecutive year of a silver deficit. The market exhibits a notable tightness, characterized by a consistent increase in industrial demand, juxtaposed with a relatively stagnant supply from mining and recycling sectors.

This deficit is not merely a temporary aberration; it has evolved into a structural issue. Despite evident market signals, the supply response has been sluggish, resulting in a bottleneck that seems increasingly untenable. The data presents a compelling narrative: from 2021 onward, silver has faced shortfalls between 79 million ounces and a projected 250 million ounces for 2025. An examination of prior bull markets in precious metals presents one of the most persuasive cases for silver. Historically, silver has demonstrated a tendency to spearhead these rallies, showcasing remarkable outperformance.

What factors contribute to silver’s typical outperformance? The response is partially rooted in the dimensions of the market. The silver market is considerably less extensive than that of gold, indicating that similar capital inflows can lead to more pronounced fluctuations in prices. Furthermore, silver’s dual function as a precious metal and an industrial commodity engenders distinctive supply-demand dynamics that may enhance upside potential in favorable market conditions.

Gold is primarily valued for its ability to preserve wealth and serve as a hedge against inflation, while silver is distinguished by its essential function in numerous industrial applications. The transition to green energy has notably impacted silver demand, as solar panels necessitate considerable quantities of the metal. Electric vehicles, electronics, and medical applications contribute significantly to the enhancement of consumption. This industrial component serves as an additional catalyst beyond monetary demand. The acceleration of technological adoption worldwide, especially in emerging markets, is contributing to an increasing industrial demand for silver, thereby establishing a solid basis for potential price appreciation.

While silver presents a potentially advantageous scenario, it is advisable for investors to engage with tactical discipline instead of considering it a long-term foundational asset. Silver exhibits significant volatility. A disciplined allocation of no more than 5% of one’s portfolio, accompanied by clearly defined exit parameters, represents the optimal approach. Whether aiming for a return of 30-50% or establishing a stop-loss of 10-15%, the essential factor is the commitment to set thresholds. The aim is to seize the expected catch-up rally, rather than to create a long-term position. For the majority of investors, silver ETFs serve as the most efficient means of gaining exposure. Their structure facilitates exchange trading, eliminating the complexities associated with physical storage, and ensures adequate liquidity for strategic positioning.

What could be considered a justifiable price target for silver? Current fair value estimates indicate a range of $53-$75, which signifies a potential upside of 50-115% from present levels. This is not simply conjecture; it is based on historical correlations with gold and an examination of fundamental supply-demand dynamics. If the gold-silver ratio were to revert merely to its long-term average of approximately 60:1, and gold prices remained steady, silver would trade at around a 70% increase from the current level. The existing configuration for silver offers an intriguing risk-reward dynamic for investors prepared to engage in a tactical allocation with well-defined parameters.

Although investing in precious metals carries inherent risks, the ongoing underperformance of silver in comparison to gold, along with the constricting physical markets, indicates that the white metal might be on the verge of finally garnering some long-awaited attention from gold investors.