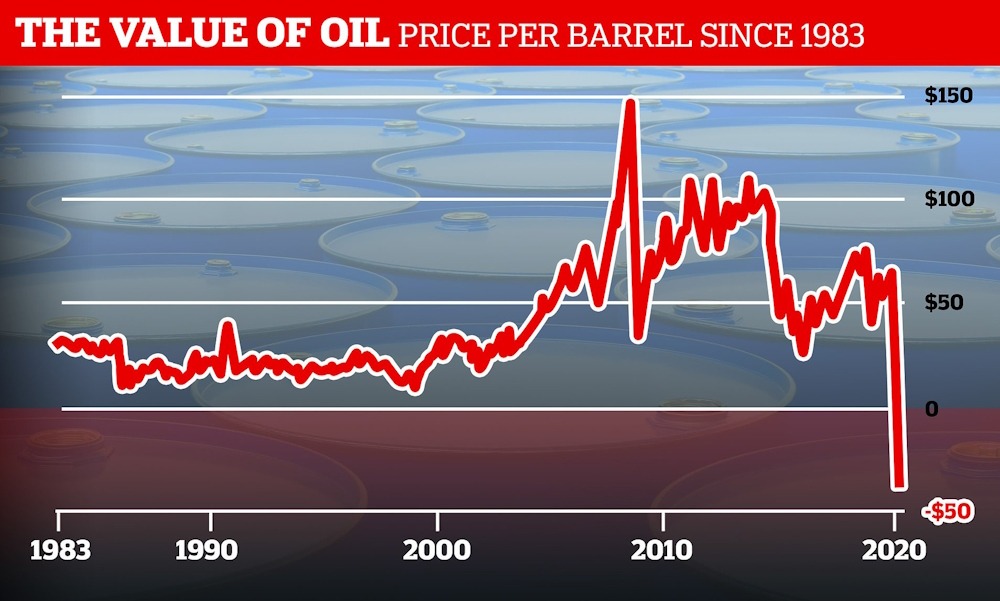

Do you recall the day when the price of a barrel of crude oil dropped below zero dollars. Five years later, prices are experiencing a downward trend once more; however, the underlying factors driving this shift differ from previous instances. Five years ago today, U.S. crude oil futures experienced an unprecedented decline, plunging below zero for the first time in history. This remarkable event shocked global markets and highlighted the inherent fragility of the physical oil trade. On April 20, 2020, the May contract for West Texas Intermediate (WTI) experienced an extraordinary settlement at minus $37.63 a barrel, driven by a lack of storage capacity and a significant decline in demand due to pandemic-related lockdowns.

Currently, although crude prices are not in negative territory, they are experiencing a downward trend—though the underlying factors driving this decline are markedly different from previous instances. The current downturn is primarily influenced by apprehensions regarding a worldwide economic deceleration, escalating trade disputes, and geopolitical instabilities. On Monday, WTI futures experienced a decline of 1.75%, settling at $63.55 per barrel, while Brent crude prices decreased to $66.77. This downturn reflects investor concerns regarding the potential economic repercussions of U.S. tariffs and the implications of sluggish global growth. The recent losses occur after a short-lived rally observed last week and arise in the context of heightened uncertainty regarding fuel demand, reminiscent of the dynamics experienced during the crisis of 2020.

The price collapse in 2020 was primarily influenced by a significant demand freeze, limitations in storage capacity in Cushing, Oklahoma, and the technical pressures associated with expiring contracts. Market participants were compelled to liquidate their holdings in a market characterized by low liquidity, resulting in settlement prices that contradicted established economic principles. In contrast, the current retreat is indicative of broader macroeconomic risks. A recent Reuters poll indicated a nearly 50% likelihood of a U.S. recession occurring within the next year, as escalating trade tensions and lackluster manufacturing data have raised concerns regarding future consumption patterns. The foremost global oil consumer is currently encountering challenges originating internally, rather than as a consequence of a pandemic.

Nonetheless, the comparisons provide valuable insights. Similar to the conditions observed in 2020, market sentiment remains delicate, with price fluctuations being exacerbated by policy decisions and investor positioning. The market appears unlikely to revert to negative territory; however, the specter of sub-zero persists, especially as geopolitical risks continue to obscure the equilibrium of supply and demand. In April 2020, the market collapse necessitated significant structural adjustments: exchange-traded funds such as the U.S. Oil Fund transitioned away from near-month futures, OPEC+ implemented unprecedented production cuts, and the CME Group adapted its framework to permit negative pricing on certain contracts. U.S. production reached 12.3 million barrels per day, exhibiting sluggishness in its adjustment despite a significant decline in demand.

OPEC+ is anticipated to raise production by 411,000 barrels per day commencing in May. In the interim, negotiations concerning the nuclear program between the U.S. and Iran have advanced, which could facilitate an increase in Iranian oil supply to the market. Supply-side uncertainty persists as a significant factor influencing price dynamics, although current storage conditions are markedly improved compared to the acute situation observed in 2020.

The 2020 crash, although initiated by extraordinary circumstances, revealed a persistent truth: oil markets are inherently vulnerable to external disruptions, whether arising from contract expirations, demand fluctuations, or policy errors. Five years later, crude oil is not facing a crisis; however, it remains susceptible to fluctuations. The five-year anniversary of sub-zero crude prices serves as more than just a historical reference; it highlights the vulnerability of even the most liquid commodity, crude oil, when fundamental factors and logistical challenges intersect.